Just so you will all know what is coming down the pipe and not be blindsided.

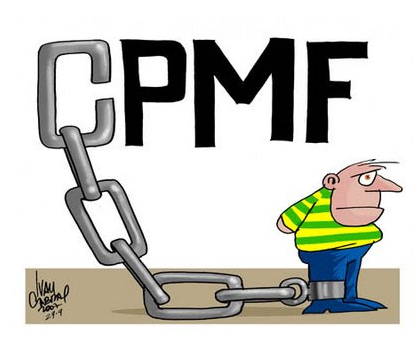

As if the taxes in this country aren't already stratospherical Brazil's Health Minister, Arthur Chioro, has proposed to reintroduce the CPMF (Contribuição Provisório sobre Movimento Financeira) which was a tax in effect until 2007, was charged on all financial transactions and was supposed to be a provisional tax dedicated to help support the public healthcare system SUS (Sistema Única da Saúde). A provisional tax that was in place for 15 years can hardly be called or even considered "provisional".

As if that wasn't bad enough, considering all the other taxes built into other financial services (water, light, gas, telephone bills, etc.) now people had to pay a tax on paying those taxes... pure robbery. Then another tax on financial transactions the IOF(Imposto sobre Operações Financeiras) was simply added on top in 2001. It didn't replace the CPMF, it was just heaped on top of it. The IOF still is charged on financial transactions today. The sickest part was that during its existence hardly any of the tax revenues generated by the CPMF actually found its way into the public healthcare system at all. Its creation was a just a fraud perpetrated on the Brazilian taxpayers from the very outset.

Now the incompetent government in this country wants to cover the losses caused by their mismanagement and robbery by simply reviving the CPMF under a new name and as a permanent tax, the CIS (Contribuição Interfederativa da Saúde). Surely it will just be added on top of the IOF, just as the IOF was added on top of the CPMF and the corrupt government of this country will just delve deeper into the pockets of the already overburdened taxpayers, sucking ever more blood out of the near-dead victim.

This tax will probably hit expats even harder than the Brazilian public, because we tend to make larger and more frequent financial transactions. We also tend to consume more energy than the lower income Brazilian families; and since these taxes are based on the amount of the transaction we'll pay proportionately higher amounts of tax.

The tax on financial transactions will also further discourage foreign investment in this country at a time when the economy is already suffering as a result of the worldwide drop in oil prices, the foundering Chinese economy upon which Brazil is far too reliant, and the endless government corruption scandals that make foreign investors (especially from the USA) extremely worried about investing here.

They've simply robbed so much that the cupboard is bare, now they want to bleed the taxpayers even more to cover those loses. It's a typical Brazilian knee-jerk reaction to cover up a much deeper problem which is surely going to backfire on them and make matters even worse in terms of the Brazilian economy.

Cheers,

James Expat-blog Experts Team

Brazilian government proposes to revive CPMF tax for healthcare system

James: I guess this will also include a tax on transfers of money from a US bank, for example, to a Brazilian bank account in the name of an ex-pat.

Also, I believe medical insurance is available for ex-pats by paying a certain premium per month. Could you please confirm? Any idea of the cost of such insurance for someone in their 70's and/or 80's?

Thanks.

Hi ndfansince53,

Yes, the new tax if enacted (which it probably will be) will apply to all financial transactions, such as bank-to-bank transfers, cash transfers through private companies like Western Union and the like, cashing foreign checks at currency exchanges that may offer check cashing services... you name it they tax it. It will apply to all checks you write on your Brazilian bank account, transfers between accounts, aranging for Cashier's Checks (Cheque Admiinistrativo) etc. They'll get every last drop of blood they possibly can, trust me.

Regarding private healthcare plans in Brazil, they are really quite expensive and many of them routinely get fined or suspended for not covering procedures they're supposed to. In fact, most of these insurers now are getting out of private plans which are much more regulated by the government, in favor of corporate plans that are subjected to very lax oversight and thus they can get away with more dark deeds. You may find it extremely difficult to find a private plan here as a result.

Cheers,

James Expat-blog Experts Team

Hi James,

It looks as if the CPMF won't be coming back...  http://www.bloomberg.com/news/articles/ … e-cpmf-tax

http://www.bloomberg.com/news/articles/ … e-cpmf-tax

However, here is one man's opinion as to why bringing back the CPMF might be a good idea...even though he admits that the CPMF is unlikely to be approved...  http://riotimesonline.com/brazil-news/o … scitated/#

http://riotimesonline.com/brazil-news/o … scitated/#

Finance Minister, Joaquim Levy also says that the CPMF is a good idea... and that without new taxes, Brazil is in danger of going the way of Greece!  http://in.reuters.com/article/2015/08/2 … K120150829

http://in.reuters.com/article/2015/08/2 … K120150829

Victoria,

The CPMF was a fraud from the get go. It was imposed with the promise that the revenues were to be dedicated to the public healthcare system. In very short order that changed and the funds simply went into general revenues and almost none of the funds found their way into the healthcare system at all. This is the main reason that the system is in such disastrous condition now. Then in 2001 along came the IOF (Imposto sobre Operações Financeiras) which didn't replace the CPMF, but was simply heaped on top of it.

While the IOF wasn't a large tax, the two combined served to bleed the Brazilian public dry every time they made any financial transaction. It also served as a great deterent to foreign investment, imports and exports and increased the cost of doing business in this country. Finally the CPMF was abolished in 2007 and the government committed itself to the promise that it would never come back. Now 8 years later... so much for another promise made by the Worker's Party government of this country.

Certainly the IOF will not be scrapped and the new tax, baptized CIS (just the CPMF with an alias) will be heaped on top of that too. If it does pass, then it will be here to stay. It is not being proposed as a temporary measure like the last time around. Just like the last time, it is highly likely that the revenues won't go to the healthcare system for very long either, before some genius in Brasília proposes that it too becomes part of general revenues.

At a time when the Brazilian economy is tanking and foreign investment is drying up, increasing the taxes already paid on financial transactions is pure insanity. The CIS will only serve to further discourage foreign investment and could find many more multinational companies pulling out of Brazil altogether. That would certainly have an extreme negative impact on the economy.

This tax is also totally unnecessary! What is necessary is to cut government spending, mismanagement and end the corruption that causes money to hemorrhage from the public purse. Fully one third of the country's Gross Domestic Product goes to feeding the top-heavy bureaucracy in Brazil. There are 26 states and the Federal District, yet there are 81 Senators, 519 Federal Deputies, 39 ministries and thousands upon thousands of public service workers. Most of them do nothing or very little and their numbers could be cut significantly. Reducing the number of Senators to 1 per state, Federal Deputies to a maximum of 4 per state, and cutting the public service by one third would result in billions of DOLLARS in savings and more than offset whatever revenues a new tax on financial operations would every bring in.

I wouldn't bet my shirt on the tax NOT being passed. I've lived here for over 13 years now, almost all of that under a PT government. I've watched it become more and more of a DICTATORSHIP with each passing day and nothing they do would surprise me. And don't forget that Dilma could simply pass it into law by Presidential Decree even if the Senate and Gongress are dead set against it.

Cheers,

James Expat-blog Experts Team

Hi James,

Sigh. I've only been in Brazil for a year, but in a year, this country has already left me so exhausted that I don't know what to say anymore. I recently received my CIE, and now I have every document that I need to work, drive, bank, and live legally in this country, but these days, all I can think about is how much better things were back home. On one hand, I recognize that Brazil is not the United States and therefore, I really shouldn't compare the two countries...but honestly, how does one come from a place like the U.S. and NOT compare the two countries? The U.S. is by no means a perfect country - it, too, has its fair share of problems - however, in comparison, Brazil is like a third world country. And if Brazil is going to behave like a third world country, at least its people and politicians should acknowledge that Brazil is a third world country. Why is the cost of goods and the cost of living here so high? If I'm expected to fork over 2-3x more than what Americans would pay for the exact same car, then why the #$%! is the average Brazilian salary a pittance compared to the average American salary?

Yes, I know...it's all the taxes imposed by the Brazilian government. But considering all the taxes that Brazilians pay, shouldn't they be getting more in return? Yes, I know...the taxes aren't being properly allocated...ok, then why the hell don't Brazilians do something about it? Why do they keep electing corrupt politicians and then let them get away with murder? And why don't they cut back on some of the perks being paid to overpaid government employees?

I don't think there's an answer. I think the very essence of Brazil is corrupt. I have a Brazilian friend who works for the state justice department. My friend told me that she knows judges who get paid R$ 100,000/month and that they also get a R$ 5,000 housing stipend and a R$ 5,000 clothing allowance each month so that they can live in a respectable home and wear respectable suits.  Why the @#$%! does someone who earn R$ 100,000/month need an additional R$ 10,000/month to spend on housing and clothing? When the country is going to hell and people are losing their jobs, do you think these judges and their lesser paid counterparts are willing to give up their "perks" so that the middle and lower classes can get a break on their taxes? Ha!

Why the @#$%! does someone who earn R$ 100,000/month need an additional R$ 10,000/month to spend on housing and clothing? When the country is going to hell and people are losing their jobs, do you think these judges and their lesser paid counterparts are willing to give up their "perks" so that the middle and lower classes can get a break on their taxes? Ha!

Brazilians are their own worst enemy.

Victoria

Victoria,

They would have to change the entire political landscape in this country for it to come anywhere near being as efficient and fair a nation as other developed nations. In almost every way, except for its economy Brazil clearly is still a third world country.

Your friend didn't tell you even the tip of the iceberg I'm afraid. Outgoing São Paulo mayor Gilberto Kassab even joked that he was going to apply for a job as parking lot attendent at SP City Hall because the attendents are paid USD $14,000 per month (no typo it is US dollars). A São Paulo Superior Court judge earns USD $361,500 per month, while a New York State Superior Court judge only earns $198,600 per year. You should read the New York Times article Brazil's Super Salaries, it will make you sick.

This is why I maintain that cutting the wasteful spending and reducing the public service by at least one third would make most taxes unnecessary, and probably launch Brazil into the first world overnight.

Cheers,

James Expat-blog Experts Team

James wrote:Victoria,

They would have to change the entire political landscape in this country for it to come anywhere near being as efficient and fair a nation as other developed nations. In almost every way, except for its economy Brazil clearly is still a third world country.

Your friend didn't tell you even the tip of the iceberg I'm afraid. Outgoing São Paulo mayor Gilberto Kassab even joked that he was going to apply for a job as parking lot attendent at SP City Hall because the attendents are paid USD $14,000 per month (no typo it is US dollars). A São Paulo Superior Court judge earns USD $361,500 per month, while a New York State Superior Court judge only earns $198,600 per year. You should read the New York Times article Brazil's Super Salaries, it will make you sick.

This is why I maintain that cutting the wasteful spending and reducing the public service by at least one third would make most taxes unnecessary, and probably launch Brazil into the first world overnight.

Cheers,

James Expat-blog Experts Team

James,

After reading the article about Brazil's Super Salaries, I don't know what to say. I'm speechless...dumbfounded.

And at the same time, I feel sick to my stomach. This country is more f@#$%! than I thought!

Victoria

Now I ask you..... can you imagine any possible reason why the Brazilian people simply put up with that? We'd start a Civil War over that kind of #@%* in Canada or the USA. It's impossible for me to figure out their keeping their mouths shut when the minimum wage they're forced to live on is abour USD $220 per month.

Their complacency is the reason this country is so screwed up in the first place.

Cheers,

James

James wrote:Now I ask you..... can you imagine any possible reason why the Brazilian people simply put up with that? We'd start a Civil War over that kind of #@%* in Canada or the USA. It's impossible for me to figure out their keeping their mouths shut when the minimum wage they're forced to live on is abour USD $220 per month.

Their complacency is the reason this country is so screwed up in the first place.

Cheers,

James

I'm curious, James. What do your Brazilian friends say? Do they just give excuses as to why things here don't change? Do they just blame the corrupt politicians and the poor people of the northeast for all their problems? I've made a few Brazilian friends, but so far, I've only joined them in their ranting and complaining about the corruption here in Brazil...I've never dared to directly criticize Brazilians and their perceived complacency and passiveness. However, I'm really starting to see that Brazilians are their own worst enemies, and this makes me really sad because they are truly some of the warmest and most welcoming people that I've ever met.

Actually my closest Brazilian friends (my students) are all well traveled and are aware of what real democracies are, and how things actually work in democratic countries. They also know that Brazil is completely unlike other countries in that the people complain among themselves only, but are otherwise totally complacent and take no organized action whatsoever. Also they understand that Brazil, unlike other countries, has crafted a set of laws that protects the corrupt politicians, giving them special courts and special prisons, if they aren't given outright immunity for their corrupt acts.

The average Brazilian just keeps quiet and takes it up the hoop, or they make lame excuses that it's all the fault of corrupt politicians. They don't understand the concept of "the squeaky wheel gets the grease," so don't organize to fight it. Also, when they do organize protests they don't have a clue how to POLICE themselves, they don't understand that the moment they allow vandals and thieves to enter their midst to take the opportunity to commit crimes, that the group loses any credibility it may have had. Thats why protests no matter how large here are totally ineffective, because they always become violent. If you tell them it's basically their own fault you'd get killed by one of them I'm sure.

But we (expats) all know that nothing HAPPENS to you that you don't ALLOW to happen. They're getting it up the hoop, because they allow the government to give it to them up the hoop, plain and simple. Trying to tell a Brazilian that is a waste of time.

Brazilians really are proof of the old saying, "You get the kind of government you deserve." Sad to say!

Cheers,

James Expat-blog Experts Team

Ms. Chandler,

Hi! from sunny Brasil. That said-Your submission about Brasil becoming the next Greece is a case of Apples and Acai. The situations are as vastly different as are the countries. Greece is a victim of the NEW WORLD ORDER. Brasil is getting SCREWED by the false ineptitude and greed of it's elected officials. This is important to point out as this blog is a means to present the truth about a marvelous country that has its potential blunted by those who are elected to maximize it. have written on other occasions that the Brasilian governments answer to EVERYTHING is tax it. One will notice, however, that the funds seem to evaporate. I agree that this is a phantom tax ment to negate the possibility of US investment in Brasil.

exnyer wrote:Ms. Chandler,

Hi! from sunny Brasil. That said-Your submission about Brasil becoming the next Greece is a case of Apples and Acai. The situations are as vastly different as are the countries. Greece is a victim of the NEW WORLD ORDER. Brasil is getting SCREWED by the false ineptitude and greed of it's elected officials. This is important to point out as this blog is a means to present the truth about a marvelous country that has its potential blunted by those who are elected to maximize it. have written on other occasions that the Brasilian governments answer to EVERYTHING is tax it. One will notice, however, that the funds seem to evaporate. I agree that this is a phantom tax ment to negate the possibility of US investment in Brasil.

Hello!

I never said that Brazil will become the next Greece...but I did post a link to an article where Brazilian Finance Minister Joaquim Levy was quoted saying that Brazil could become the next Greece if it doesn't clean up its act.

However, I do agree with everything else that you said about Brazil.

Well folks, starting to look more and more like this insane rebirth of the CPMF is going to get pushed through whether Brazilians like it or not.

It's laughable to hear those within government who are proponents of the tax stating it will only be a temporary measure lasting no more than 4 years. Strange that it just coincides with the remainder of the current presidential mandate should our beloved Dilma not be impeached first. Funny, isn't that exactly what they said about the CPMF the first time around? Didn't the say it was a temporary measure and even put it in the name? (the P in CPMF is for PROVISÓRIO)

Well folks I don't know what dicitionary this incompetent government is using, but the first time around the CPMF lasted 14 years. That's hardly what I would call temporary. What guarantees that it would be done away with after the 4 years they predict? They've given "Scout's Honor"???

Again it's a tax that will be heaped on top of another existing tax, the IOF (Impostos sobre Operações Financeiras) just like when the IOF was created and there were 7 years when both were being collected on every financial transaction made in this country. Now that is going to be the same situation all over again.

In a time of financial crisis, a tax that is going to feed inflation and will have a negative impact not only foreign investment, but on major purchase made by Brazilians such as buying cars and homes, this is going to have a devastating impact on the civil construction and automotive industries that are already suffering. Simply put, reintroduction of the CPMF simply makes no sense at all, the overall impact is going to be far worse than the current situation and for what? Do they actually think it's going to raise their rating with Standards & Poors????

Looks like we're all going to be in for a very bumpy ride for the foreseeable future, better hold on to your hats!!!

Strangely enough Brazilian banks seem to be supporting the return of the CPMF. Could it be that they're getting some kind of under the table kickbacks on what's being collected??? That sounds typically Brazilian, doesn't it?

Cheers,

James Expat-blog Experts Team

James, my husband and I are in the process of buying an apartment. The owner accepted our offer this morning, and the ball started rolling today. This week, the bank will assess our credit, and we expect to be approved by the end of the week (we are financing a small percentage of the purchase price), and our bank representative told us that we could close "escrow" (Is this what they call it here?) in 45 days. I know that things might very well take longer than 45 days - after all, this is Brazil - but 45 days from now is October 30. If the CPMF is approved, will it become effective before October 30?

Hi Victoria,

There is no date set presently since the measures still have to go before Congress to be passed. I guess it all comes down to just how urgent the politicians in Brasília think this issue is and how quickly they move on it. The spending cuts are urgent, but the "ressurection" of the CPMF or whatever they decide to call it is very contentious and there are a lot of Deputados who will surely vote against it. So there is still a slim ray of hope that at least the CPMF won't be approved at all. We just have to wait and see, but I think that it won't come into effect that soon. That said, if it does pass you'll pay the tax on your mortgage payments from that point on, once it does go into effect.

Cheers,

James Expat-blog Experts Team

Also you will end up paying the existing IOF (Imposto sobre Operações Financeiras) on the whole amount of funds you will be transferring into Brazil from any foreign financial institution.

Cheers,

James Expat-blog Experts Team

James wrote:Also you will end up paying the existing IOF (Imposto sobre Operações Financeiras) on the whole amount of funds you will be transferring into Brazil from any foreign financial institution.

Cheers,

James Expat-blog Experts Team

We won't be transferring in any foreign funds. I appreciate the information though!

So, what exactly is the CPMF, how much is it, who will pay it, on what will you have to pay it? And more importantly how can you avoid paying the CPMF?

The CPMF (Contribuição Provisório sobre Movimentações Financeiras) will be paid by every individual and business on ALL banking transactions. That includes deposits, withdrawls (even from the ATM), paying bills, transfers, everything. The only exceptions will be for automatic deposit of your salary, transfers between your own accounts, purchasing share on the stock market (Bolsa de Valores) and Fixed Income Bonds, unemployment insurance, retirement pension.

The tax rate will be 0.2% of the value of the transaction, so to figure it out you multiply the total of the transaction by 0.002 to calculate the tax you'll pay.

So, for example if you withdraw R$100 thousand from the bank to make a downpayment on a home, you'll pay R$200 on that transaction. If you write a check for R$30 thousand to purchase a car, you'll pay R$60 on that transaction. If you transfer R$1 thousand to the account of another person, you'll pay R$2. If you pay your electric bill of R$185, then on top of the other built-in taxes on the utility bill your going to pay an additional 37 centavos. They're going to bleed you dry, bit-by-bit and in some cases will be taxing the same money more than once. If for example you withdraw money from the ATM, to for your daily living expenses you have already paid CPMF on that amount. If you use part of that money to pay a bill at another bank then you're going to pay CPMF on that transaction, so you're paying the tax on that portion of your money that was already taxed once when you withdrew it. In my opinion this is absolutely criminal, but that's Brazil for you.

How do you avoid paying the CPMF? Well in most cases you simply can't, there are many transactions that you simply can't make unless you use a bank. You can't, for example, go directly to the electric company and pay your bill there. They'll laugh you right out of the building. You have to pay at a bank, or online so you pay CPMF. The only way you can avoid CPMF is firstly if you're lucky enough to be paid in CASH by your employer, or if you're self-employed your customers pay you in cash. Then if you pay everything that you possibly can in cash you won't pay the CPMF on those transactions. Other than that, be prepared for the tax man to take that little extra bite out of your wallet.

Certainly this is going to have a much more negative impact on the Brazilian economy that these idiots in Brasília are trying to lead you to believe. Either they're blind and stupid and just can't see that, or they're just setting us all up for a bigger bite somewhere down the road when they say, "Oops, it wasn't enough and we have to increase it."

The CPMF when combined with IOF, and other Capital Controls that already exist is going to serve only to further dry up foreign investment coming into Brazil. Even with the US dollar being almost 4 to one, the taxes and increased cost of doing business are simply going to turn off investors completely and they'll look elsewhere to make their profits.

The tax is obviously going to effect the real estate sector since Brazilians are going to think twice about purchasing a home with one more tax added to the numerous taxes they pay on that purchase. This will trickle down to the construction industry and mean less new starts.

It will clearly effect the automobile industry, which is already in trouble, since fewer and fewer people will be purchasing cars. Good Lord, there are already enough taxes involved with the purchase, ownership, operation and licensing of cars.

The CPMF will simply fuel the underground economy which is already flourishing in Brazil. People are going to start insisting on being paid only in cash, they'll be working under the table, not reporting income and exchanging services or goods in order to avoid cash at all. Nobody will be willing to provide receipts for anything either. This is going to be a nightmare and these jerks in government just can't see it. Here in Brazil everything is taxes, taxes, taxes, and all just to pay for their incompetence and dishonesty.

I'm not certain how it's going to work, but I think they'll even factor in the CPMF if you purchase using a debit card so even those of us with foreign accounts are going to end up paying it on ATM withdrawals and debit purchases.

Cheers,

James

Nice and Thank you.